How We Invest

Driven by our views of the trends shaping societies, we invest today with tomorrow in mind, so every generation prospers.

We aim to build a resilient and forward looking portfolio that delivers sustainable returns over the long term. We deploy capital to catalyse solutions that can enable companies to transition to a more sustainable future, tap on opportunities to invest in future growth sectors and business models, and encourage enterprises to transform through efforts in innovation. Our investment activities are aligned to four structural trends that shape our long term portfolio construction.

Digitisation and Sustainable Living are megatrends with a pervasive impact across all sectors and on the business models of incumbent and emerging businesses. Future of Consumption and Longer Lifespans reflect structural shifts in consumption patterns and growing needs arising from population growth and longer expected lifespans. These trends are interconnected, transcend sectors and countries, and persist through economic cycles.

We continue to align our portfolio with such trends. We invest into companies that directly enable, drive, and benefit from these trends.

We set aside a small portion of our investment capital to back innovations and technologies at pre-commercialisation stages. We are cognisant of the risks and challenges these early stage companies face and accept the binary risks that come with investing in them. However, these companies also have the potential to achieve significant growth over time and deliver outsized returns. In addition, we engage closely with portfolio companies on their efforts to assess potential disruption risks and to identify transformation opportunities arising from these new technologies.

Integrating ESG Across Our Investments

We apply an Environmental, Social, and Governance (ESG) assessment framework throughout our investment process to ensure that the opportunities we consider align with our sustainability objectives. We also continue to engage investee companies to advance best practices post-investment. Among the objectives are achieving our climate targets, helping to develop diverse, equitable, and inclusive workplaces, and fostering good governance.

We evaluate material ESG factors as part of our due diligence for each investment we are considering. In addition, as an active shareholder in companies and an investor in funds, we engage with our investees on their sustainability priorities, practices, and stance.

Investment Framework and Risk-adjusted Cost of Capital

Our investment discipline is centred around intrinsic value and our risk-return framework. This framework forms the basis of our investment decisions, capital allocation, performance measurement, and incentive system.

For each investment, we conduct a bottom-up intrinsic value analysis, with expected returns evaluated against a risk-adjusted cost of capital that we derive using the capital asset pricing model.

Each investment's risk-adjusted cost of capital is based on its country risk, industry risk, and capital structure. Investments in riskier sectors or markets will have higher costs of capital.

We add an illiquidity risk premium for unlisted investments and a venture risk premium for early stage investments. Our risk-adjusted cost of capital framework helps to normalise the assessment of risks as we compare the relative attractiveness among investment opportunities.

We also factor into each investment an internal carbon price of US$50 per tonne of carbon dioxide equivalent (tCO2e), to assess the possible climate transition impact and to further guide our investment decisions. We expect to increase this to US$100 per tCO2e by 2030.

This allows us to better allocate capital with regard to investment opportunities, and evaluate the risks related to the long term value of our portfolio, adjusted amongst other things, for the confluence of future carbon taxes and levies, as well as the potential increase in financial costs arising from the pace of mitigation, adaptation, and transition.

Capital Allocation

At the portfolio level, we set a three-year rolling capital allocation and divestment plan that is reviewed by senior management and approved by our Board annually. This plan guides our investment and divestment activities, and liquidity, to maintain a strong balance sheet.

We have full discretion as an owner and investor to reshape and rebalance our investment holdings as the situation warrants. From time to time, we may invest in or divest from selected positions based on our outlook and risk-return appetite. We may take concentrated positions, remain in cash, and/or use derivatives to hedge currency or protect against potential losses of our underlying investments.

Our investments are predominantly in equities. We adopt a long term view of our investments and are not focused on short term volatility. We do not have targets for investing by asset class, country, sector, or single name. We manage our liquidity and balance sheet for resilience and investment flexibility.

Portfolio Composition

Our portfolio comprises both listed and unlisted assets, including our investments in funds. The unlisted portfolio has grown steadily over the years as we invested in attractive opportunities in the private markets and benefitted from the increase in the value of our unlisted assets.

As at 31 March 2023, 47% of our portfolio was in liquid and listed assets, and 53% was in unlisted assets and funds.

Unlisted Investments

We value our unlisted investments at book value less impairment. We only recognise any value uplift of these investments upon listing or sale. Over the last decade, our unlisted portfolio generated returns of over 10% per annum, delivering higher returns than our listed portfolio.

Marking our unlisted portfolio to market would provide S$18 billion of value uplift which is approximately 9% of our unlisted portfolio as at 31 March 2023.

Our unlisted portfolio is well diversified across geographies and sectors.

Unlisted Singapore companies constitute over a third of our unlisted portfolio and include mature companies such as Mapletree, PSA, and SP Group.

Our asset management businesses are approximately a sixth of our unlisted portfolio and include Seviora Holdings and Vertex Holdings. Our asset management businesses manage around S$79 billion in assets, which includes third-party capital as well as our own capital.

Investments in private equity and credit funds are approximately a sixth of our unlisted portfolio. They have enabled us to gain deeper insights into new markets and sub-sectors of specialisation, and have provided co-investment opportunities.

The rest of our unlisted portfolio comprises direct investments into private companies. Our investments include Ant Group, A.S. Watson, Ceva Santé Animale, Element Materials Technology, Global Healthcare Exchange, Rivulis, Schneider Electric India, Topsoe, Verily Life Sciences, and WuXi AppTec and represent over a quarter of our unlisted portfolio.

Our unlisted portfolio offers us liquidity through divestments; steady dividends from mature companies; and distributions from the high-quality portfolio of funds we have built up over the years. The funds are well diversified across geographies, sectors, and vintages. We also achieve liquidity from our unlisted portfolio through public listings. For example, in the past five years, some of our holdings such as Adyen, Meituan, and Roblox have listed.

Early Stage Investments

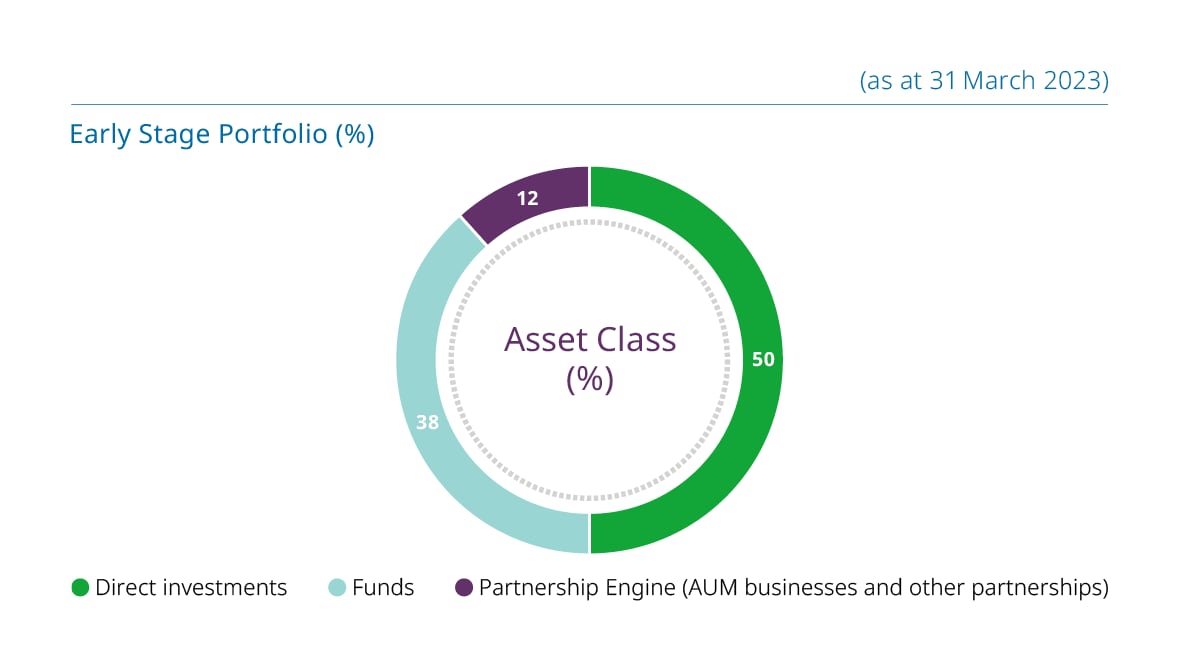

As an asset owner seeking sustainable returns over the long term, we want to anticipate what is around the corner. We invest in early stage companies to keep abreast of the latest technologies and innovations; to identify potential winners early and scale up investment as companies develop; and to drive broader portfolio development efforts.

Investing in early stage companies means we accept the binary risks associated with such investments. However, they also have the potential to achieve significant growth over time and deliver outsized returns. Given the higher underlying risk, our early stage portfolio is diversified across geographies and sectors, and we evaluate performance for this strategy on an overall portfolio basis.

We manage our early stage risk exposure by incorporating a venture risk premium into the cost of capital for these investments and by sizing our investments appropriately. We typically invest smaller amounts at the time of initial investment, with a view to increasing our stake if the company demonstrates successful de-risking. In addition, we cap our exposure to this segment to 6% of our overall portfolio as part of our risk management framework. Currently, our early stage investments, including exposure through venture capital funds, account for under 6% of our total portfolio.

Over time, early stage companies may mature into successful growth stage entities and generate attractive returns for our portfolio. Since 2016, we have been actively making early stage investments, which after marking them to market, have generated returns above industry averages.

As an active and engaged shareholder, we seek to add value to our listed and unlisted investee companies across all stages of growth, from early stage to mature enterprises. We work together with our portfolio companies to enhance value through partnerships, innovation, growth strategies, and transformational possibilities. We proactively promote good governance, ethical business practices, and compliance with all laws.

We encourage our companies to adhere to the highest standards by having quality boards. Boards should have a high level of independence, which involves having separate persons holding the Chairman and CEO roles. We hold the boards accountable for the activities of their companies. We look to them to drive strategy and oversee management, who, in turn, are responsible for the day-to-day operations of their companies.